SPP Polymer Limited planning to raise up to Rs. 24.49 crore from public issue; IPO opens September 10

New Delhi [India], September 9: SPP Polymer Limited, a leading manufacturing company for over two decades, promoted by Mr Dipak Goyal, Mr Mahavir Bahety & Mr Liladhar Mundhara, is planning to raise Rs. 24.49 crores from its SME public issue. The company has received approval to launch its public issue on the NSE Emerge Platform of the National Stock Exchange. The public issue opens for subscription on September 10 and closes on September 12. The Proceeds of the public issue will be utilised to meet the company’s working capital requirement, prepay or repay loans availed and general corporate purposes. Interactive Financial Services Ltd is the book-running lead manager of the issue.

The initial public offering of Rs. 24.49 crore comprises a fresh issue of 4,150,000 shares of face value of Rs. 10 each. The company has a fixed price of Rs. 59 per share for the public issue. The minimum lot size for retail investors is 2000 shares, amounting to a minimum investment of Rs 118,000.

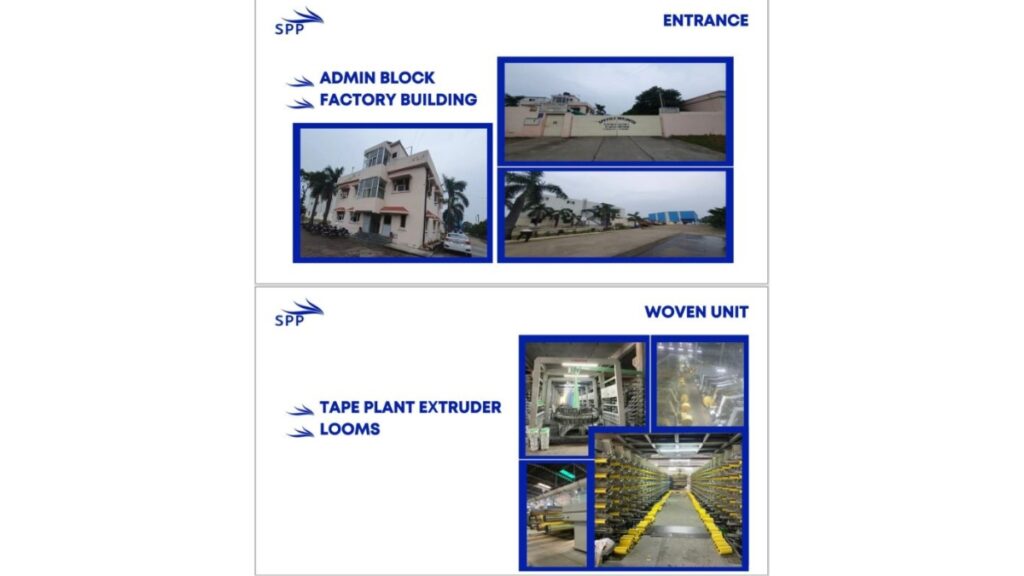

Incorporated in 2004, SPP Polymer Limited, formerly known as SPP Food Products Private Limited, is situated at Sidcul Rudrapur, Uttarakhand; it owns a land area of 13650 sq mtr and a constructed area of 7500 sq meters. It manufactures a wide range of HDPE/PP woven fabric and bags, non-woven fabrics and bags, and Multifilament Yarn. The company is located in Rudrapur City, Uttarakhand.

The product portfolio comprises HDPE/PP woven Fabric, HDPE/PP Woven Bags, Non-woven Fabric, non-woven Bags and Multifilament PP Yarn.

The company offers customised solutions according to its clients’ specifications. Its installed capacity of HDPE/PP Woven Fabric and bags totals 9125 MT, Non-woven Fabric 3600 MT, and Multifilament Yarn 300 MT per annum.

The company has received ISO 9001:2015, 45001:2018, 14001:2015, and SA 8000:2014 accreditation for its quality, occupational health and safety management, and environmental management systems.

The company provides packaging solutions to business-to-business (“B2B”) manufacturers catering to different industries such as cement, chemicals, food grains, sugars, polymers, agriculture, and others for the packaging of goods in large quantities.

Highlights:-

- Fresh Public issue of 41.5 lakh equity shares opens for subscription from September 10 to September 12

- The company engaged in the business of manufacturing HDPE/PP woven fabric & bags, Non-woven fabrics & bags and PP Multifilament yarn

- Minimum lot size for application is 2000 shares; Minimum IPO application amount Rs. 1.18 lakh

- Funds raised through the issue will be used to meet the working capital requirements, repayment of loans and general corporate purposes

- For Q1FY25, the company reported revenues of Rs. 28.95 crore and a Net Profit of Rs. 91.33 lakh

Interactive Financial Services Ltd is the book-running lead manager of the issue.

Business Highlights:-

The company has reported excellent operational and financial performance over the years. The Company has witnessed a multi-fold growth in revenue and profitability over the years. For FY23-24 ended March, the company reported a net profit of Rs. 99.40 lahks and revenue of Rs. 91.75 crores as compared to profitability and revenue of Rs. 54.42 lahks and Rs. 66.04 crore in FY22-23.

As of June 2024, the company’s Net Worth was reported at Rs. 25.91 crore, Reserves & Surplus at Rs. 15 crore and Asset base of Rs. 76.19 crore. As of March 2024, the ROE of the company was 8.01%, ROCE was 4.27%, and RONW was 3.98%. The company’s shares will be listed on NSE’s Emerge platform.

| IPO Highlights – SPP Polymer Limited | |

| IPO Opens on | September 10, 2024 |

| IPO Closes on | September 12, 2024 |

| Issue Price | Rs. 59 Per Share |

| Issue Size | 41.5 lakh shares – up to Rs. 24.49 crore |

| Lot Size | 2000 Shares |

| Listing on | NSE Emerge Platform of National Stock Exchange |

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.