Ahmedabad Among Top Cities Fueling India’s Digital Payment Boom, according to Kearney India and Amazon Pay Report

Ahmedabad (Gujarat) [India] August 22: Ahmedabad, amongst other large and mid-size cities in India, is at the forefront of the country’s digital payments revolution. Digital payment methods now account for roughly 65% of overall transactions in these areas, compared to around 75% in larger cities, reflecting a significant change in consumer behavior, according to the latest findings from the Kearney India and Amazon Pay India’s “How Urban India Pays” report. This comprehensive study, based on a survey spanning 120 cities and over 6,000 consumers and 1,000 merchants, reveals a seismic shift in payment preferences. The report introduces the Degree of Digital Payment Usage (DDPU), a metric designed to measure the extent of digital payment adoption among various demographic groups. The DDPU uses a multidimensional approach using three foundational pillars: volume (digital transaction frequency), variety (diversity of categories in which digital payment methods are utilized), and openness (awareness and receptiveness toward emerging digital payment methods).

A comprehensive study by Kearney India and Amazon Pay India sheds light on the evolving payments landscape, unveiling a strong digital adoption rate in smaller towns comparable to larger metros.

Digital payments have penetrated small towns:Consumers in small towns highlighted that 65% of theirpayment transactions are digital, while consumers in larger cities cited this ratio to be ~75%.

Convenience and Innovation drive Penetration: From online purchases to street vendors selling fruits, flowers and everyday items, digital payments make inroads across sectors, driven by convenience cited as the primary motivator by over 60% of respondents.

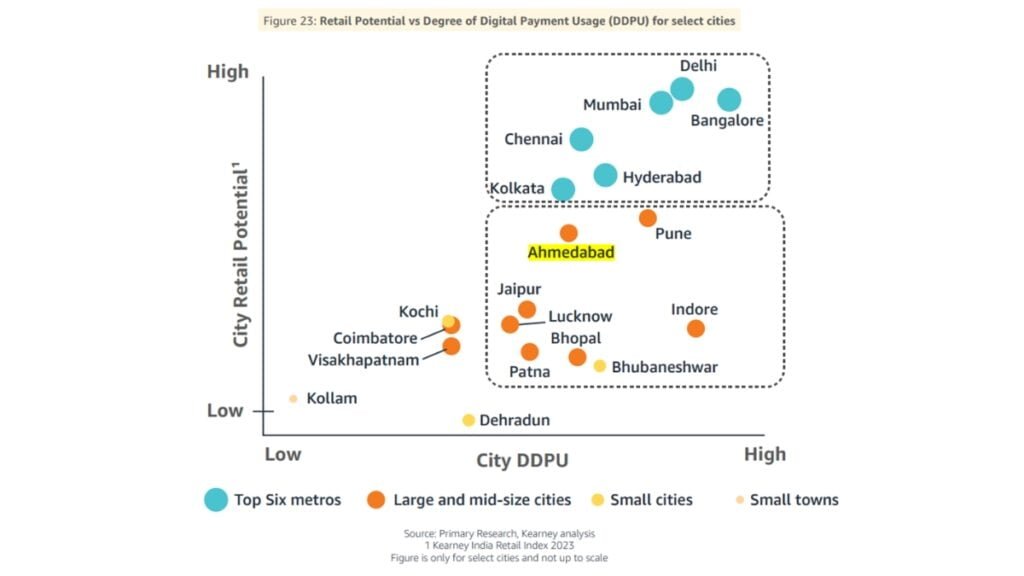

A strong correlation exists between a city’s average DDPU and its retail potential, as measured by the Kearney India Retail Index. Interestingly, Ahmedabad along with selected other locales such as Jaipur, Pune, Indore, Lucknow, Bhopal, Bhubaneswar, and Patna present an intriguing pattern with impressive levels of digital payment adoption. Despite their relatively lower retail potential compared to the top metros, these cities exhibit digital payment adoption rates comparable to those of the larger metros, highlighting the widespread and robust penetration of digital payments across different urban cities.

“Ahmedabad is a shining example of India’s digital payments revolution gaining momentum across the nation,” said Vikas Bansal, CEO, Amazon Pay India.“Our ‘How Urban India Pays’ report reveals that cities like Ahmedabad are leading the charge in adopting digital transactions, spanning from bustling local markets to family-owned businesses. This transformation signals a pivotal push for stakeholders to innovate, collaborate and ensure a secure and inclusive digital payments ecosystem. Amazon Pay is committed to providing seamlessdigital payment experiences that empower individuals and businesses across Ahmedabad and beyond. We will continue simplifying lives through frictionless digital experiences that fulfill aspirations and uplift communities”, he added.

Ahmedabad, known for its entrepreneurial spirit and vibrant textile industry, is embracing digital payment technologies. The city’s retail sector, traditionally driven by its bustling markets and family-owned businesses, is now rapidly integrating these modern solutions. This transition is largely influenced by Ahmedabad’s business-savvy population, who value efficiency and the benefits of digital transactions including cashbacks and rewards. The city’s openness to innovation, coupled with a deep respect for tradition, is driving a unique blend of modern financial practices within its culturally rich framework.

As digital payment adoption continues to rise, cities like Ahmedabad are set to play a crucial role in shaping the future of retail commerce in India, bridging the gap between traditional markets and the modern digital economy.The report provides an in-depth analysis of this dynamic shift, offering valuable insights for customers and merchants aiming to navigate the evolving landscape of Indian consumer finance.

Here’s a glimpse into urban India’s digital payment landscape, as categorized under the segment of large and mid-size cities:

UPI Reigns Supreme: UPI emerges as the undisputed leader in the city, mirroring a national trend. Over 37% of transactions in large and mid-sized cities like Ahmedabad are conducted through UPI, highlighting its dominance for everyday purchases.

Rewards Drive Adoption: For consumers in the city, rewards programs are a significant factor influencing their choice of digital payment methods. This resonates with the national trend where rewards rank as the third most important factor for digital payment adoption in large and mid-sized cities like Ahmedabad, following convenience and speed.

Digital Wallets Gaining Traction: Digital wallets are another digital payment method gaining ground in Ahmedabad. Around 13% of transactions in large and mid-sized cities utilize digital wallets for their convenience.

Credit Card Usage on the Rise: While lagging behind UPI, credit card usage in the city is showing promise. Up to 7% of transactions in large and mid-sized cities involve credit cards, indicating a growing comfort level with credit-based payments.

Retail Potential and Digital Payments: The city’s retail potential, as assessed by the Kearney India Retail Index, underscores its status as a promising market for digital payment growth. The city’s retail attractiveness, determined by factors such as market size, consumption indicators, and ease of doing business, complements its high degree of digital payment adoption. This synergy between retail potential and digital payments is evident in Ahmedabad’s vibrant market dynamics.

Ahmedabad along with selected other locales such as Jaipur, Pune, Indore, Lucknow, Bhopal, Bhubaneswar, and Patna present an intriguing pattern with impressive levels of digital payment adoption. Despite their relatively lower retail potential compared to the top metros, these cities exhibit digital payment adoption rates comparable to those of the larger metros, highlighting the widespread and robust penetration of digital payments across different urban cities.

Emerging Payment Modes and BNPL: The city shows promising potential for the adoption of emerging payment modes. Familiarity of Buy Now Pay Later (BNPL) solutions are growing, with 88% of respondentsaware about the payment option. Additionally, the city’s familiarity with wearable payments(27%) and voice-activated assistants(24%), though slightly behind larger metros, presents opportunities for future growth and innovation in the digital payment space.

Access the full report here.

About Amazon Pay

Amazon Pay is a trusted, convenient, and rewarding way to pay for anything, anywhere on and off Amazon.in. Amazon continues to extend the convenience of Amazon Pay by making it possible for millions of customers to make digital transactions and continue supporting the government’s vision of encouraging electronic payment, leading to a less-cash society in India.

Amazon Pay provides a wide choice of payment methods like Amazon Pay UPI, Amazon Pay Balance, Amazon Pay Later, and Amazon Pay ICICI Bank Credit Card to make everyday payments safe, fast, and frictionless for customers and merchants. With an aim to simplify lives and fulfill the aspirations of every Indian, it offers customers the benefit of “one-click” payments (on certain instruments) leading to a faster and smoother checkout process. With its cash-load facility in Amazon Pay Wallet, Amazon Pay also solves the pain point of tendering the exact amount of cash at the time of delivery.

For more information on Amazon Pay visit: https://www.amazon.in/amazonpay/home

Follow us on LinkedIn: https://www.linkedin.com/company/amazon-pay-india/